Did you know about these?

Rental Income tax tips

This does not mean you should stop collecting rent, it just means you might not have to include all the rent you've collected in your taxable rental income.

- You don't have to report your rental income if you rented out your property or vacation home for 14 days or less.

- Rental income is taxable in the year it is collected. If you did not receive the last month's rent in the current year, do not report the income in the current year.

- Exclude Security Deposits from your rental income if you plan on returning the deposits at the end of lease.

To learn more about saving money on taxes, try the property management software and other money saving real estate software from TReXGlobal.com.

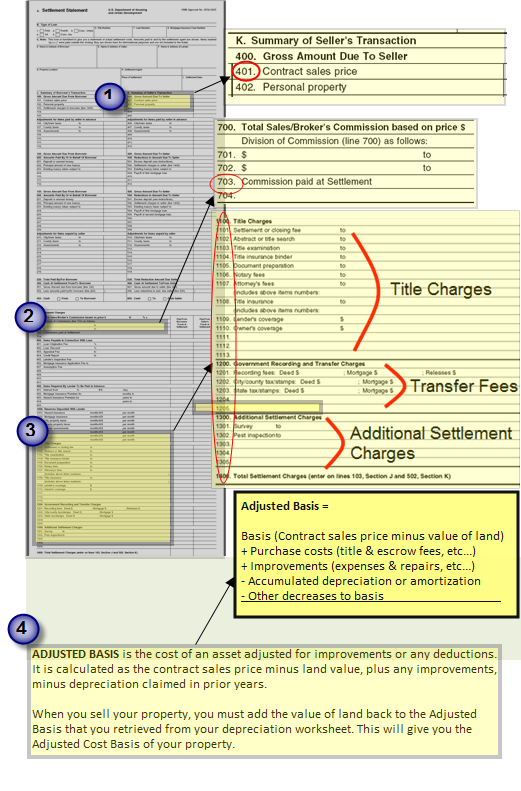

Minimize Taxable Gain using sale expenses

You should deduct Commissions Paid, Title Charges, Recording and Transfer Charges, and Additional Settlement Costs from the Contract Sales Price. This will help you minimize gain, and lower the tax liability on your sold property.

To learn more about saving money on taxes, try the property management software and other money saving real estate software from TReXGlobal.com.

Looking for new property while on vacation

At least half of the time you spent away on travel must have been spent doing business, and the primary cause for travel must be business. Common business expenses that you can deduct while scouting for new investment properties are fees for travel, lodging, and services.

To learn more about saving money on taxes, try the property management software and other money saving real estate software from TReXGlobal.com.

Ordinary and Necessary Advertising Expenses

Common expenses can be advertisements on the radio, in the newspaper, classified lists, and phone books. Other expenses may include the cost of signs, banners, and postage for mailers. You can even deduct the cost of advertising for vacancies, including the cost of building a web site – just be sure that they are “ordinary and necessary” for your rental activity.

To learn more about saving money on taxes, try the property management software and other money saving real estate software from TReXGlobal.com.

Loan Costs need to be Amortized

Find your amortization deduction by adding all the loan costs from your property's settlement statement and dividing by the loan term (30 years, etc...). The yearly amortization deduction gets reported on IRS form 4562 for the life of the loan. If you refinance the property, you will get to deduct all the remaining loan costs that year, after which you will have a new amortization schedule for your new loan.

To learn more about saving money on taxes, try the property management software and other money saving real estate software from TReXGlobal.com.

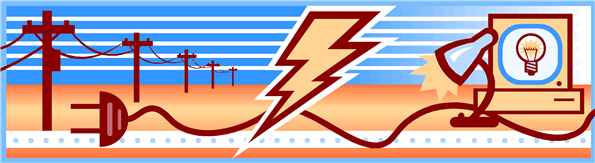

Deducting Tenant Utilities that the Landlord Pays

Landlords often incur expenses to light common areas or operate security systems on their properties. Other common expenses include power, water, gas, and cable, and internet.

Any utility costs incurred during a period of vacancy are also fully deductible - but be careful. Deducting large expenses during periods of vacancy can be a reason for the IRS to become suspicious.

To learn more about saving money on taxes, try the property management software and other money saving real estate software from TReXGlobal.com.

How to Deduct Losses, Even When You Have No Expense

These losses may be limited, but they are deductible as a rental activity expense. For example, your tenant runs their car through the garage door. Even though you haven't replaced the garage door and don't have any expenses because you didn't fix anything, you can deduct the cost of damages incurred as a casualty expense.

Casualty losses on rental property are reported on Schedule A from IRS Form 4684, and are not subject to the 2% AGI limitation or $100 deduction.

To learn more about saving money on taxes, try the property management software and other money saving real estate software from TReXGlobal.com.

Deductible Start-Up Expenses

Start-up expenses are costs incurred while creating an active trade or for investigating the creation of a business or trade. This includes expenses incurred when acquiring an existing for profit activity, as well as expenses incurred during the anticipated production of income.

Common start-up expenses may include:

- Accounting fees

- Analysis, survey, or study of potential markets, products, labor supply, transportation facilities, etc.

- Advertisements for the opening of the business.

- Office equipment and furniture, setup costs

- Salaries and wages for employees who are being trained and their instructors.

- Travel and other necessary costs for securing prospective distributors, suppliers, or customers.

- Salaries and fees for executives and consultants, or for similar professional services

Keep in mind that certain expenses must be amortized over 5 years. Such expenses include legal expenses and expenses for setting up the business structure (as an LLC, etc...)

To learn more about saving money on taxes, try the property management software and other money saving real estate software from TReXGlobal.com.

Sell Property to Yourself

For example, say you lived in a property for three years, and rented it out for the next seven years - since you haven't lived there for two out of the last five years, you cannot sell the property as a primary residence to avoid the capital gain. However, after moving out of the property, you sell it to your own S-Corporation, which allows you to exclude capital gain (up to $250k, $500k if married filing jointly) because requirements for the two-year rule have been met. The other advantage is you can have a new basis for depreciation on your appreciated property. Selling to your S-Corp isn't for everyone though. You should avoid using this strategy if you cannot take advantage of the exclusion amount.

To learn more about saving money on taxes, try the property management software and other money saving real estate software from TReXGlobal.com.

Pay your Kids, Open their IRAs

You can pay your kids to do work on your properties, and put the money in IRA accounts for them. This is especially a good idea if you've already maxed out on your and your spouse's IRA contribution for the year. You're better off avoiding the taxes on your extra income, and the money will be safe in a tax free shelter.

And of course, it's a great way to help your kids prepare for their first property!

To learn more about saving money on taxes, try the property management software and other money saving real estate software from TReXGlobal.com.

Giving Gifts that Lower Taxes

A gift that is intended for the eventual personal use or benefit of a particular person or class of people will be considered a gift to that person or class of people. If you give a gift to a member of a customer's family, the gift is generally considered to be an indirect gift to the customer. This rule does not apply if you have an independent business connection with that family member and the gift is not intended for the customer's eventual use.

Incidental costs, like gift wrapping, packaging, insuring, and mailing, are generally not included in determining the cost of the gift. You cannot deduct gift items that cost less than $4 if they have your name clearly and permanently imprinted on the gift, or if the gift is one of many identical items that you widely distribute, like pens and cases. Signs, display racks, and other promotional materials also cannot be deducted as gifts.

To learn more about saving money on taxes, try the property management software and other money saving real estate software from TReXGlobal.com.

Making Health Insurance a Rental Expense

Structuring your rental property as a Limited Liability Company (LLC) may permit you to deduct these costs for you and your family, but you should talk to a tax advisor to find out more.

Everyone's tax situation is different, and this information should not substitute professional advice. Taxpayers should always consult with their tax advisors to consider specific factors that might affect their situation. You can also refer to IRS Publication 535 to learn more about business expenses.

To learn more about saving money on taxes, try the property management software and other money saving real estate software from TReXGlobal.com.

Repairs due to Vandalism can be Expensed Immediately

For example, say you replaced an entire window frame on your property. Normally the cost would get added back to the basis and depreciated because windows are a component of the building structure (depreciated over 27.5 years).

However, since the improvement is the result of vandalism, it is treated like a repair, and the costs are deducted in the year the expenses are incurred.

Everyone's tax situation is different, and this information should not substitute professional advice. Taxpayers should always consult with their tax advisors to consider specific factors that might affect their situation. You can also refer to IRS Publication 535 to learn more about business expenses.

To learn more about saving money on taxes, try the property management software and other money saving real estate software from TReXGlobal.com.

Traveling Away from Home

You can also deduct expenses incurred while staying overnight when traveling for business.

You cannot deduct the cost of traveling away from home if the primary purpose of the trip was the improvement of your property. You can read Publication 463 to learn the specifics.

Everyone's tax situation is different, and this information should not substitute professional advice. Taxpayers should always consult with their tax advisors to consider specific factors that might affect their situation. You can also refer to IRS Publication 535 to learn more about business expenses.

To learn more about saving money on taxes, try the property management software and other money saving real estate software from TReXGlobal.com.

Collecting Rent in advance

If your rental expenses exceed rental income, and your AGI limitations do not allow you to claim a loss, you can decrease the loss carryover by increasing rental income.

Since rental income is taxable in the year it is collected, rental losses can be offset by collecting rent in advance. By increasing rental income for the year, you have the leverage to deduct more of your expenses.

Everyone's tax situation is different, and this information should not substitute professional advice. Taxpayers should always consult with their tax advisors to consider specific factors that might affect their situation. You can also refer to IRS Publication 535 to learn more about business expenses.

To learn more about saving money on taxes, try the property management software and other money saving real estate software from TReXGlobal.com.

Hire Family Members to Manage Your Properties

Obviously, the expense of your own labor cannot be written off, but that doesn't mean your spouse or children have to work for free.

By hiring family members, it won't bother you to pay management fees because the expense is fully deductible, and the money stays within your family. Keep in mind you'll have to withhold Social Security and Medicare taxes for the income you pay.

AND of course, hiring a professional is always a good idea. Your teenager might not be the greatest candidate to collect rent :)

Everyone's tax situation is different, and this information should not substitute professional advice. Taxpayers should always consult with their tax advisors to consider specific factors that might affect their situation. You can also refer to IRS Publication 535 to learn more about business expenses.

To learn more about saving money on taxes, try the property management software and other money saving real estate software from TReXGlobal.com.

Real Estate Taxes

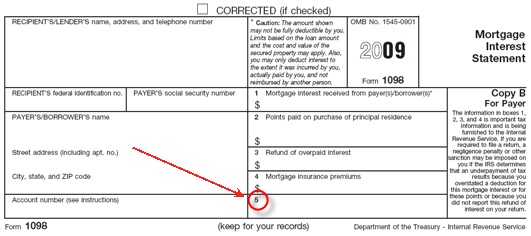

If you have a mortgage, usually the total amount is reported on your mortgage interest statement (IRS Form 1098). In addition to real estate taxes, the interest recipient may use box 5 to give you other information, like the address of the property that secures the debt, and insurance paid from escrow.

Real estate taxes get reported on Schedule E if it's an investment property. Generally, the amount will not include taxes charged for local benefits and improvements that increase the value of your property. For example, real estate taxes connected with assessments for improvements are not deductible when paid. Instead, they are added to the cost of the land.

Everyone's tax situation is different, and this information should not substitute professional advice. Taxpayers should always consult with their tax advisors to consider specific factors that might affect their situation. You can also refer to IRS Publication 535 to learn more about business expenses.

To learn more about saving money on taxes, try the property management software and other money saving real estate software from TReXGlobal.com.